AI使用LSMC方法对美国期权定价

编辑

1

2025-06-30

提示词

现在需要用LSMC方法演示对美国期权定价,请给出示例代码。

答案

import numpy as np

import matplotlib.pyplot as plt

from sklearn.linear_model import LinearRegression

from scipy.stats import norm

class AmericanOptionLSMC:

def __init__(self, S0, K, T, r, sigma, n_paths=50000, n_steps=100, option_type='put'):

self.S0 = S0 # 初始股价

self.K = K # 行权价

self.T = T # 到期时间(年)

self.r = r # 无风险利率

self.sigma = sigma # 波动率

self.n_paths = n_paths # 模拟路径数

self.n_steps = n_steps # 时间步数

self.option_type = option_type.lower() # 期权类型(call/put)

self.dt = T / n_steps # 单步时间长度

self.discount = np.exp(-r * self.dt) # 单步贴现因子

def _generate_paths(self):

"""生成几何布朗运动价格路径[3,9](@ref)"""

paths = np.zeros((self.n_steps + 1, self.n_paths))

paths[0] = self.S0

for t in range(1, self.n_steps + 1):

z = np.random.standard_normal(self.n_paths) # 随机数

paths[t] = paths[t-1] * np.exp(

(self.r - 0.5 * self.sigma**2) * self.dt +

self.sigma * np.sqrt(self.dt) * z

)

return paths

def _calculate_payoff(self, S):

"""计算即时行权收益[5](@ref)"""

if self.option_type == 'call':

return np.maximum(S - self.K, 0)

else: # put

return np.maximum(self.K - S, 0)

def _lsm_pricing(self, paths):

"""最小二乘蒙特卡洛核心算法[3,5](@ref)"""

# 初始化现金流矩阵(最后时刻收益)

cash_flows = self._calculate_payoff(paths[-1])

exercise_matrix = np.zeros_like(cash_flows) # 记录最优行权时刻

# 从到期前一步开始回溯

for t in range(self.n_steps - 1, 0, -1):

S_t = paths[t]

in_the_money = self._calculate_payoff(S_t) > 0 # 实值路径索引

if np.sum(in_the_money) > 0:

# 继续持有价值 = 未来现金流贴现均值

continuation_value = cash_flows * self.discount ** (self.n_steps - t)

# 回归估计条件期望函数(使用二次多项式)[3](@ref)

X = S_t[in_the_money].reshape(-1, 1)

Y = continuation_value[in_the_money]

reg = LinearRegression()

reg.fit(np.column_stack([X, X**2]), Y) # 特征: [S, S^2]

estimated_cont_value = reg.predict(np.column_stack([X, X**2]))

# 比较立即行权与持有价值

immediate_exercise = self._calculate_payoff(S_t[in_the_money])

exercise_now = immediate_exercise > estimated_cont_value

# 更新现金流和行权标记

cash_flows[in_the_money] = np.where(

exercise_now,

immediate_exercise,

continuation_value[in_the_money]

)

exercise_matrix[in_the_money] = np.where(

exercise_now,

t,

exercise_matrix[in_the_money]

)

# 计算期权现值(所有路径贴现均值)

present_values = cash_flows * np.exp(-self.r * self.dt * exercise_matrix)

return np.mean(present_values), exercise_matrix

def price(self):

"""主定价函数"""

paths = self._generate_paths()

price, exercise_matrix = self._lsm_pricing(paths)

# 计算欧式期权价格对比[9](@ref)

european_price = self._european_option_price()

return price, european_price, paths, exercise_matrix

def _european_option_price(self):

"""欧式期权解析解(BSM模型)[9](@ref)"""

d1 = (np.log(self.S0 / self.K) + (self.r + 0.5 * self.sigma**2) * self.T) / (self.sigma * np.sqrt(self.T))

d2 = d1 - self.sigma * np.sqrt(self.T)

if self.option_type == 'call':

return self.S0 * norm.cdf(d1) - self.K * np.exp(-self.r * self.T) * norm.cdf(d2)

else:

return self.K * np.exp(-self.r * self.T) * norm.cdf(-d2) - self.S0 * norm.cdf(-d1)

# 示例使用

if __name__ == "__main__":

# 参数设置

params = {

'S0': 100, # 初始股价

'K': 105, # 行权价

'T': 1, # 到期时间(年)

'r': 0.05, # 无风险利率

'sigma': 0.2, # 波动率

'n_paths': 10000, # 路径数量(实际应用需>50,000)

'n_steps': 50, # 时间步数

'option_type': 'call' # 期权类型

}

# 定价计算

lsmc = AmericanOptionLSMC(**params)

american_price, european_price, paths, exercise_matrix = lsmc.price()

# 结果输出

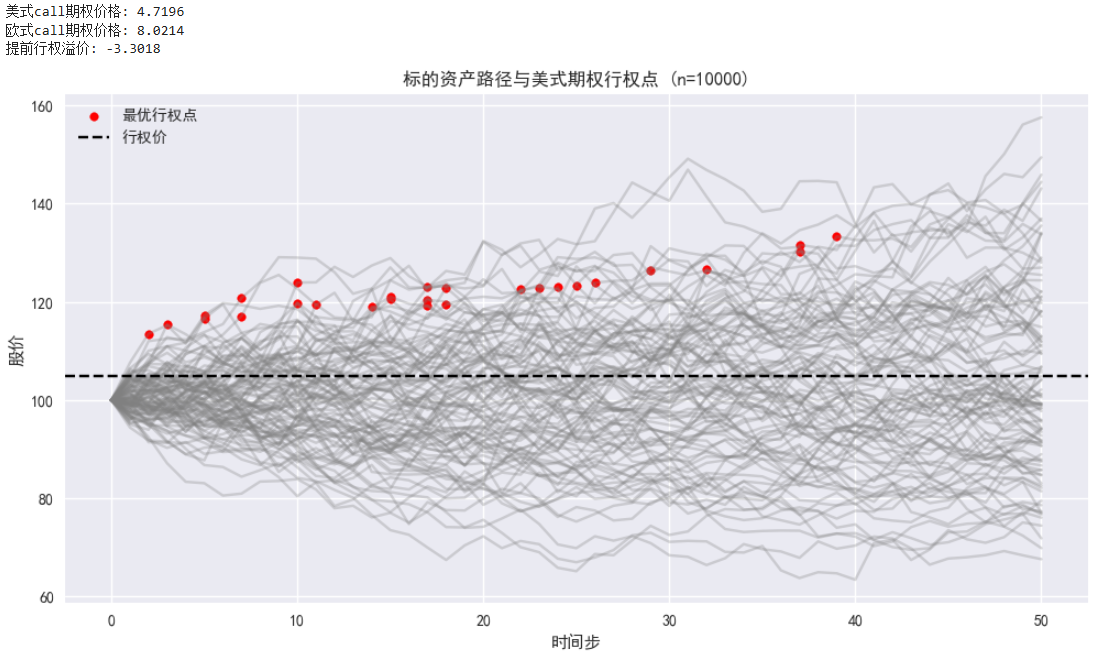

print(f"美式{params['option_type']}期权价格: {american_price:.4f}")

print(f"欧式{params['option_type']}期权价格: {european_price:.4f}")

print(f"提前行权溢价: {american_price - european_price:.4f}")

# 可视化路径与行权点

plt.figure(figsize=(12, 6))

for i in range(100): # 展示100条路径

plt.plot(paths[:, i], color='gray', alpha=0.3)

# 标记最优行权点

exercise_points = []

for path_idx in range(100):

t = int(exercise_matrix[path_idx])

if t > 0: # 排除未提前行权路径

exercise_points.append((t, paths[t, path_idx]))

if exercise_points:

t_vals, s_vals = zip(*exercise_points)

plt.scatter(t_vals, s_vals, color='red', s=30, label='最优行权点')

plt.axhline(y=params['K'], color='black', linestyle='--', label='行权价')

plt.title(f"标的资产路径与美式期权行权点 (n={params['n_paths']})")

plt.xlabel('时间步')

plt.ylabel('股价')

plt.legend()

plt.show()

结果:

美式期权可以提前行权,对比最后的欧式期权,就可以得出提前行权的收益,负值则不如到期行权的欧式。

- 0

- 0

-

赞助

支付宝

支付宝

微信

微信

-

分享