AI生成交易信号

编辑

1

2025-06-30

提示词

price = pd.read_excel('../数据/601001策略回测实验数据.xlsx',

index_col='日期')

# 将index转换成datetime格式

price.index = pd.to_datetime(price.index)

# 保留收盘价

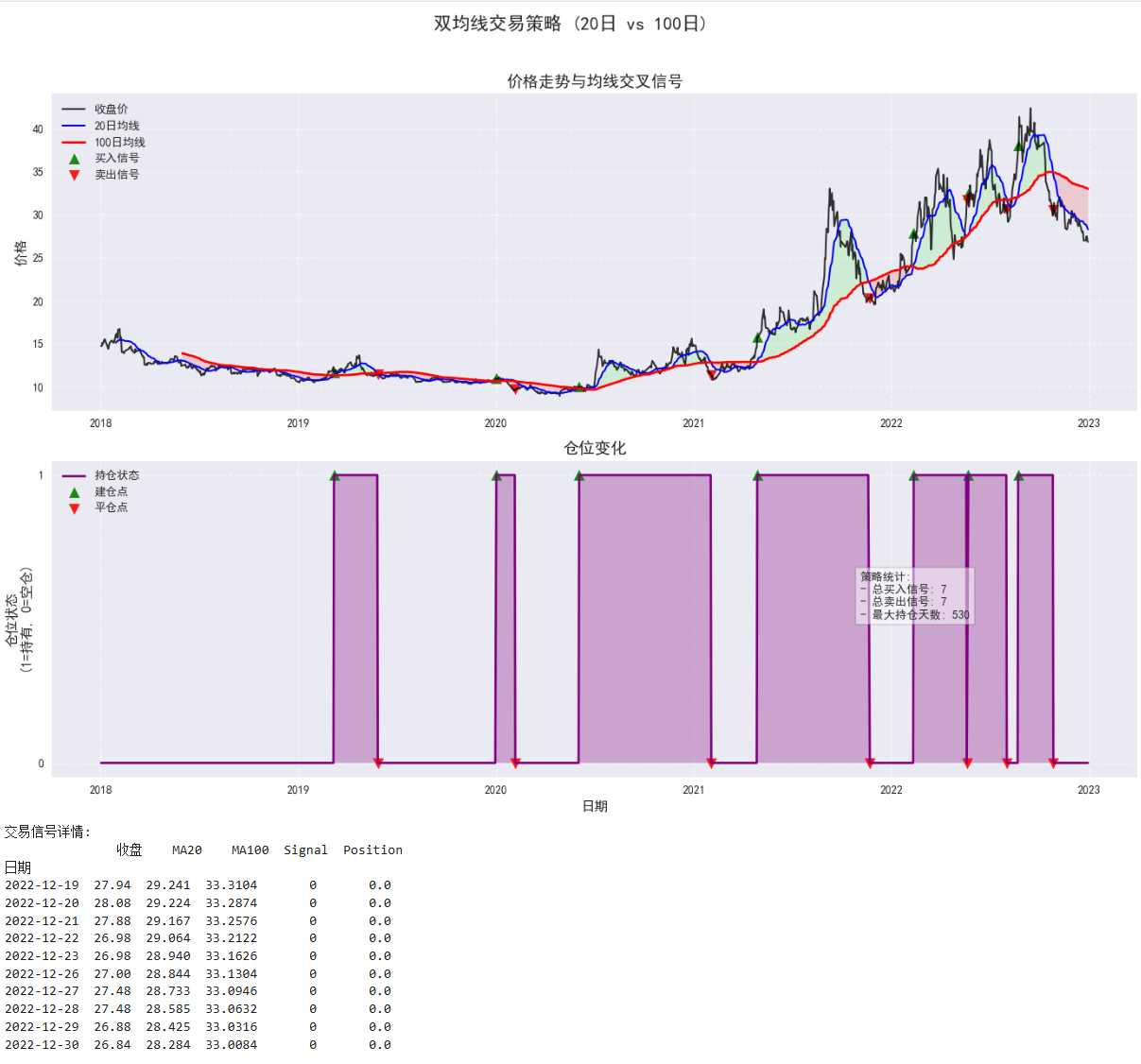

price = price[['收盘']]

在名叫price的DataFrame中,保存了某只股票的每日收盘价。现在需要基于长短期均线生成交易信号,具体为当20日均线上穿100日均线时买入,否则卖出,最后将收盘价、长短期均线和根据交易信号发生的仓位变化进行可视化,仓位变化需要以子图的形式显示在下方,请给出示例代码。

答案

import pandas as pd

import numpy as np

import matplotlib.pyplot as plt

from matplotlib.ticker import MaxNLocator

# 计算移动平均线

price['MA20'] = price['收盘'].rolling(window=20).mean() # 20日均线

price['MA100'] = price['收盘'].rolling(window=100).mean() # 100日均线

# 生成交易信号 (1:买入, 0:卖出)

price['Signal'] = np.where(price['MA20'] > price['MA100'], 1, 0)

# 计算仓位变化 (当信号从0变1时买入,从1变0时卖出)

price['Position'] = price['Signal'].diff()

# 创建可视化图表

plt.figure(figsize=(14, 10))

plt.suptitle('双均线交易策略 (20日 vs 100日)', fontsize=16, fontweight='bold')

# 价格和均线图 (主图)

ax1 = plt.subplot(2, 1, 1)

ax1.plot(price.index, price['收盘'], label='收盘价', color='black', linewidth=1.5, alpha=0.8)

ax1.plot(price.index, price['MA20'], label='20日均线', color='blue', linewidth=1.5)

ax1.plot(price.index, price['MA100'], label='100日均线', color='red', linewidth=2)

# 标记买入卖出信号

buy_signals = price[price['Position'] == 1]

sell_signals = price[price['Position'] == -1]

ax1.scatter(buy_signals.index, buy_signals['收盘'],

marker='^', s=80, color='green', alpha=0.9, label='买入信号')

ax1.scatter(sell_signals.index, sell_signals['收盘'],

marker='v', s=80, color='red', alpha=0.9, label='卖出信号')

# 填充均线之间的区域

ax1.fill_between(price.index, price['MA20'], price['MA100'],

where=price['MA20'] >= price['MA100'],

facecolor='lightgreen', alpha=0.3, interpolate=True)

ax1.fill_between(price.index, price['MA20'], price['MA100'],

where=price['MA20'] < price['MA100'],

facecolor='lightcoral', alpha=0.3, interpolate=True)

ax1.set_title('价格走势与均线交叉信号', fontsize=14)

ax1.set_ylabel('价格', fontsize=12)

ax1.legend(loc='upper left')

ax1.grid(True, linestyle='--', alpha=0.6)

# 仓位变化图 (子图)

ax2 = plt.subplot(2, 1, 2, sharex=ax1)

ax2.plot(price.index, price['Signal'],

label='持仓状态', color='purple', linewidth=2)

ax2.fill_between(price.index, 0, price['Signal'],

where=price['Signal'] >= 0,

facecolor='purple', alpha=0.3)

# 标记仓位变化点

ax2.scatter(buy_signals.index, np.ones(len(buy_signals)),

marker='^', s=80, color='green', alpha=0.9, label='建仓点')

ax2.scatter(sell_signals.index, np.zeros(len(sell_signals)),

marker='v', s=80, color='red', alpha=0.9, label='平仓点')

ax2.set_title('仓位变化', fontsize=14)

ax2.set_ylabel('仓位状态\n(1=持有, 0=空仓)', fontsize=12)

ax2.set_xlabel('日期', fontsize=12)

ax2.legend(loc='upper left')

ax2.yaxis.set_major_locator(MaxNLocator(integer=True)) # Y轴只显示整数

ax2.grid(True, linestyle='--', alpha=0.6)

# 添加策略说明

stats_text = f"策略统计:\n- 总买入信号: {len(buy_signals)}\n- 总卖出信号: {len(sell_signals)}\n- 最大持仓天数: {price['Signal'].sum()}"

plt.figtext(0.75, 0.25, stats_text, bbox=dict(facecolor='white', alpha=0.5), fontsize=10)

plt.tight_layout(rect=[0, 0, 1, 0.96]) # 为标题留出空间

plt.savefig('双均线交易策略可视化.png', dpi=300, bbox_inches='tight')

plt.show()

# 输出交易信号详情

print("交易信号详情:")

print(price[['收盘', 'MA20', 'MA100', 'Signal', 'Position']].dropna().tail(10))

结果:

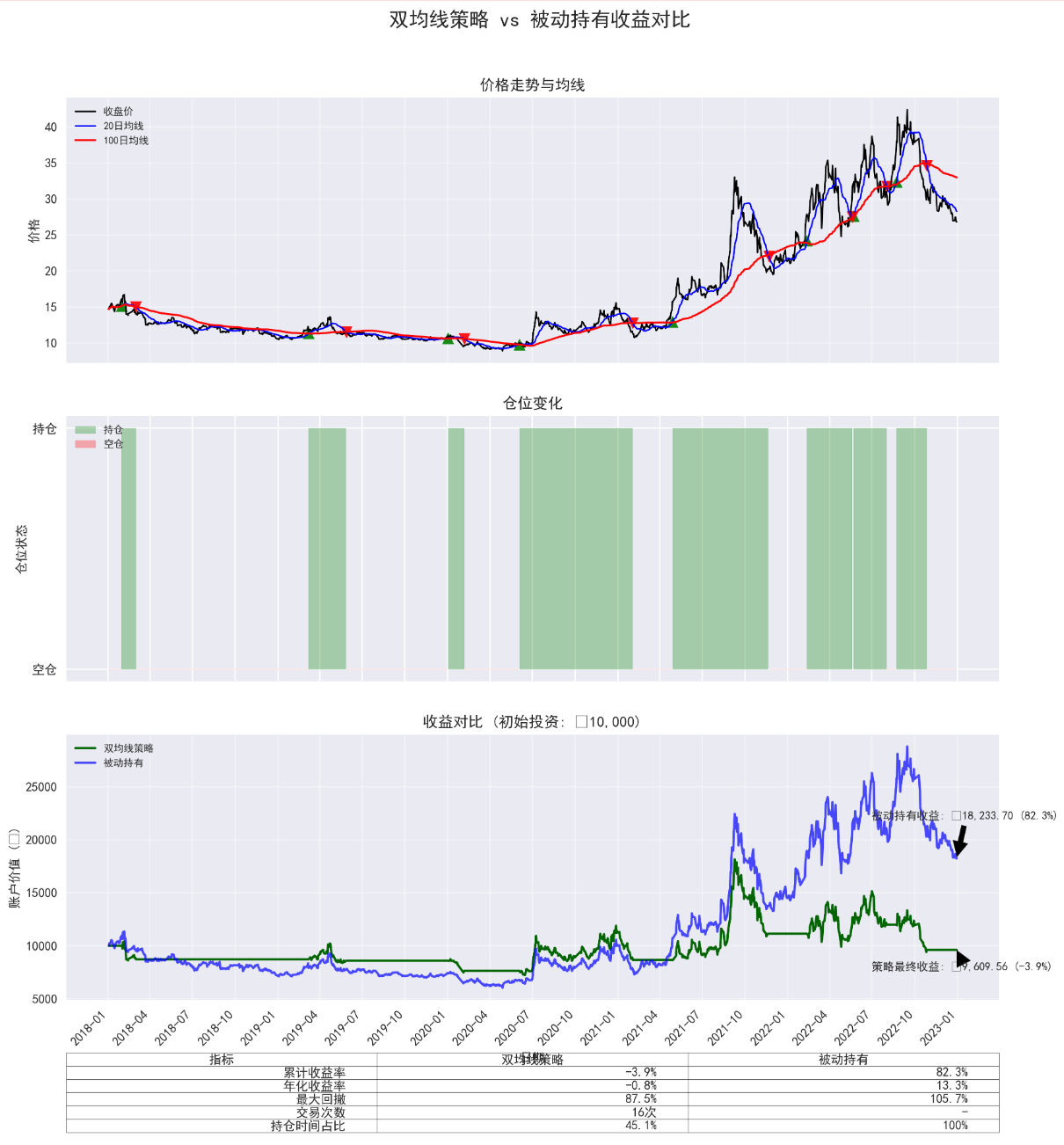

计算交易策略的收益

简化代码加描述

提示词

# Python代码

# 计算20日均线和100日均线

price['short_mavg'] = price['收盘'].rolling(window=20, min_periods=1).mean()

price['long_mavg'] = price['收盘'].rolling(window=100, min_periods=1).mean()

# 生成交易信号

price['signal'] = 0.0

price['signal'][price['short_mavg'] > price['long_mavg']] = 1.0

# 绘制收盘价和均线

plt.figure(dpi=300)

plt.subplot(2, 1, 1)

plt.plot(price['收盘'], label='收盘价',lw=1)

plt.plot(price['short_mavg'], label='20日均线',lw=1)

plt.plot(price['long_mavg'], label='100日均线',lw=1)

plt.title('收盘价和均线')

plt.legend()

# 绘制仓位变化

plt.subplot(2, 1, 2)

plt.fill_between(price.index, price['signal'],

color='green', #alpha=0.5,

where=(price['signal'] == 1.0))

plt.fill_between(price.index, price['signal'],

color='red', #alpha=0.5,

where=(price['signal'] == 0.0))

plt.title('仓位变化')

plt.tight_layout()

plt.savefig('图12-1.jpg', dpi=300)

plt.show()

基于上面的代码,将持仓的收益与该股票被动持有的收益进行对比,并将对比结果可视化,请给出示例代码。

答案

import pandas as pd

import numpy as np

import matplotlib.pyplot as plt

import matplotlib.dates as mdates

import matplotlib.ticker as mtick

# 计算移动平均线

price['short_mavg'] = price['收盘'].rolling(window=20, min_periods=1).mean()

price['long_mavg'] = price['收盘'].rolling(window=100, min_periods=1).mean()

# 生成交易信号

price['signal'] = 0.0

price['signal'] = np.where(price['short_mavg'] > price['long_mavg'], 1.0, 0.0)

# 计算每日收益率

price['daily_return'] = price['收盘'].pct_change()

# 计算策略收益

price['strategy_position'] = price['signal'].shift(1) # 使用前一天的信号避免未来函数

price['strategy_return'] = price['strategy_position'] * price['daily_return']

price['strategy_cumulative'] = (1 + price['strategy_return']).cumprod()

# 计算被动持有收益

price['buy_hold_return'] = price['daily_return']

price['buy_hold_cumulative'] = (1 + price['buy_hold_return']).cumprod()

# 计算累计收益

initial_value = 10000 # 假设初始投资10000元

price['strategy_value'] = initial_value * price['strategy_cumulative']

price['buy_hold_value'] = initial_value * price['buy_hold_cumulative']

# 设置绘图风格

plt.style.use('seaborn-v0_8')

#指定字体,防止中文出现乱码,windows系统指定为‘SimHei’

plt.rcParams['font.sans-serif'] = ['SimHei']

#这行代码让中文的负号“-”可以正常显示

plt.rcParams["axes.unicode_minus"]=False

# 创建图表

fig, (ax1, ax2, ax3) = plt.subplots(3, 1, figsize=(12, 12), dpi=300, sharex=True)

fig.suptitle('双均线策略 vs 被动持有收益对比', fontsize=16, fontweight='bold')

# 绘制价格和均线

ax1.plot(price.index, price['收盘'], label='收盘价', lw=1.2, color='black')

ax1.plot(price.index, price['short_mavg'], label='20日均线', lw=1.2, color='blue')

ax1.plot(price.index, price['long_mavg'], label='100日均线', lw=1.5, color='red')

ax1.set_title('价格走势与均线', fontsize=12)

ax1.set_ylabel('价格', fontsize=10)

ax1.legend(loc='upper left', fontsize=8)

ax1.grid(True, alpha=0.4)

# 标记金叉死叉点

gold_cross = price[(price['short_mavg'] > price['long_mavg']) &

(price['short_mavg'].shift(1) <= price['long_mavg'].shift(1))]

death_cross = price[(price['short_mavg'] < price['long_mavg']) &

(price['short_mavg'].shift(1) >= price['long_mavg'].shift(1))]

ax1.scatter(gold_cross.index, gold_cross['short_mavg'],

marker='^', s=80, color='green', alpha=0.9, label='金叉(买入)')

ax1.scatter(death_cross.index, death_cross['short_mavg'],

marker='v', s=80, color='red', alpha=0.9, label='死叉(卖出)')

# 绘制仓位变化

ax2.fill_between(price.index, price['signal'],

color='green', alpha=0.3,

where=(price['signal'] == 1.0), label='持仓')

ax2.fill_between(price.index, price['signal'],

color='red', alpha=0.3,

where=(price['signal'] == 0.0), label='空仓')

ax2.set_title('仓位变化', fontsize=12)

ax2.set_ylabel('仓位状态', fontsize=10)

ax2.set_yticks([0, 1])

ax2.set_yticklabels(['空仓', '持仓'])

ax2.legend(loc='upper left', fontsize=8)

# 绘制收益对比

ax3.plot(price.index, price['strategy_value'],

label='双均线策略', lw=1.8, color='darkgreen')

ax3.plot(price.index, price['buy_hold_value'],

label='被动持有', lw=1.8, color='blue', alpha=0.7)

ax3.set_title('收益对比 (初始投资: ¥10,000)', fontsize=12)

ax3.set_ylabel('账户价值 (¥)', fontsize=10)

ax3.set_xlabel('日期', fontsize=10)

ax3.legend(loc='upper left', fontsize=8)

ax3.grid(True, alpha=0.4)

# 添加最终收益标注

final_strategy = price['strategy_value'].iloc[-1]

final_buy_hold = price['buy_hold_value'].iloc[-1]

strategy_return_pct = (final_strategy - initial_value) / initial_value * 100

buy_hold_return_pct = (final_buy_hold - initial_value) / initial_value * 100

ax3.annotate(f'策略最终收益: ¥{final_strategy:,.2f} ({strategy_return_pct:.1f}%)',

xy=(price.index[-1], final_strategy),

xytext=(price.index[-1] - pd.DateOffset(months=6), final_strategy * 0.8),

arrowprops=dict(facecolor='black', shrink=0.05),

fontsize=9)

ax3.annotate(f'被动持有收益: ¥{final_buy_hold:,.2f} ({buy_hold_return_pct:.1f}%)',

xy=(price.index[-1], final_buy_hold),

xytext=(price.index[-1] - pd.DateOffset(months=6), final_buy_hold * 1.2),

arrowprops=dict(facecolor='black', shrink=0.05),

fontsize=9)

# 设置x轴日期格式

ax3.xaxis.set_major_locator(mdates.MonthLocator(interval=3))

ax3.xaxis.set_major_formatter(mdates.DateFormatter('%Y-%m'))

plt.xticks(rotation=45, ha='right')

# 调整布局

plt.tight_layout(rect=[0, 0, 1, 0.96]) # 为总标题留空间

plt.subplots_adjust(hspace=0.2) # 调整子图间距

# 添加统计信息表格

stats_data = [

["累计收益率", f"{strategy_return_pct:.1f}%", f"{buy_hold_return_pct:.1f}%"],

["年化收益率",

f"{(price['strategy_cumulative'].iloc[-1] ** (252/len(price)) - 1) * 100:.1f}%",

f"{(price['buy_hold_cumulative'].iloc[-1] ** (252/len(price)) - 1) * 100:.1f}%"],

["最大回撤",

f"{((price['strategy_value'].cummax() - price['strategy_value']).max() / initial_value * 100):.1f}%",

f"{((price['buy_hold_value'].cummax() - price['buy_hold_value']).max() / initial_value * 100):.1f}%"],

["交易次数", f"{len(gold_cross) + len(death_cross)}次", "-"],

["持仓时间占比", f"{price['signal'].mean() * 100:.1f}%", "100%"]

]

table = plt.table(cellText=stats_data,

colLabels=['指标', '双均线策略', '被动持有'],

loc='bottom',

bbox=[0, -0.5, 1, 0.3])

table.auto_set_font_size(False)

table.set_fontsize(10)

table.scale(1, 1.5)

# 保存和显示

plt.savefig('收益对比分析.jpg', dpi=300, bbox_inches='tight')

plt.show()

结果:

交易策略最后收益还不如一直持有,要调整。

- 0

- 0

-

赞助

支付宝

支付宝

微信

微信

-

分享